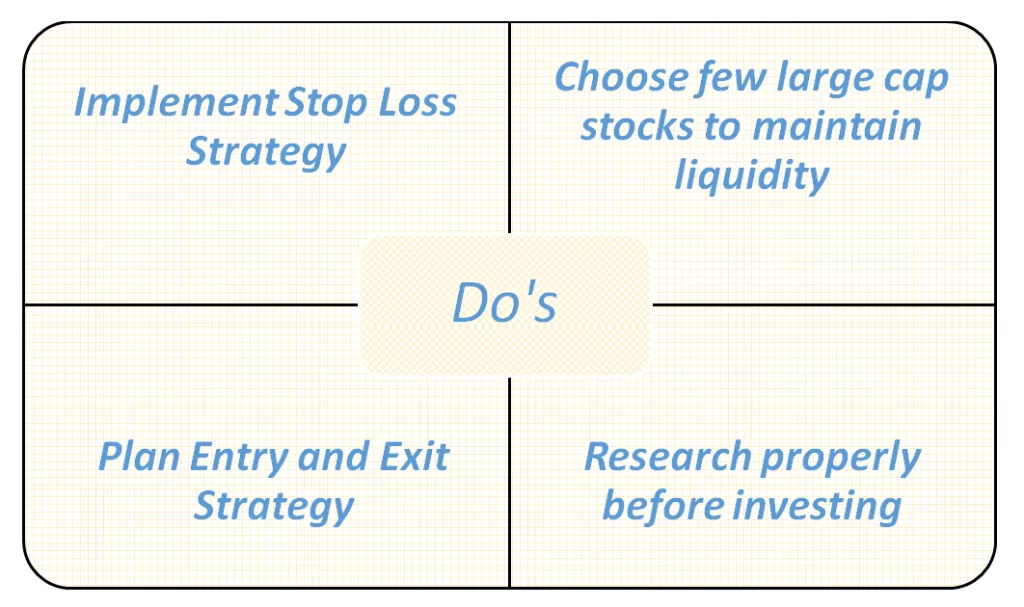

Intraday trading looks simple and easy to operate but earning money on this platform can be tricky. However, knowledge of the stock and optimal strategy can lead a trader to earn easy profits. The traders always need good stock advice to make a profit in intraday trading. There are some of the Do’s and Don’ts which need to be taken care of to earn 5000 Per Day in Intraday trading.

📌 Let’s Learn How to Make Profit in Intraday Trading:

#1 Implement Stop Loss Strategy

In Intraday trading it is important to put a strategy in place. There are various strategies like Intraday time analysis which can help a trader to save its loss and earn high returns but most of the popular methods is the Stop loss strategy. This is one of the easy methods to achieve the highest intraday profit in India. Here the trader put a stop loss on its stock to save losses. Stop loss also helps in making an emotion-free decision and it is very important for traders who trade in short selling.

#2 Choose few large-cap stocks to maintain liquidity

In Intraday trading, the trader should try to keep some of its stocks with high trading volumes. It helps the trader to manage risk and a cushion to earn more in day trading. The large-cap stocks help traders in selecting sufficient buyers at any point of time in the market which helps in maintaining liquidity in hand.

#3 Plan Entry and Exit Strategy

It is one of the important tips in intraday trading is to know when to enter and when to exit from the market. The trader should avoid making impulsive decisions in the market. The exit strategy should be planned beforehand to achieve success in the market. It is really common to change decisions immediately after the purchase order and this can lead to losing an optimal opportunity for earning profits. Hence a trader should always think distinctly about the target price, buying price, and exit strategy to earn Rs 5,000 per day in the share market.

#4 Research properly before investing

The key rule in any investment is to research properly before investing. It is one of the major Do’s in intraday trading to analyze and control over the trading of stocks. The research helps in assisting the risk and it also helps the investor in diversifying the stocks. The best way is to research is to analyze price movements with the help of Intraday time analysis charts like Hourly Charts.

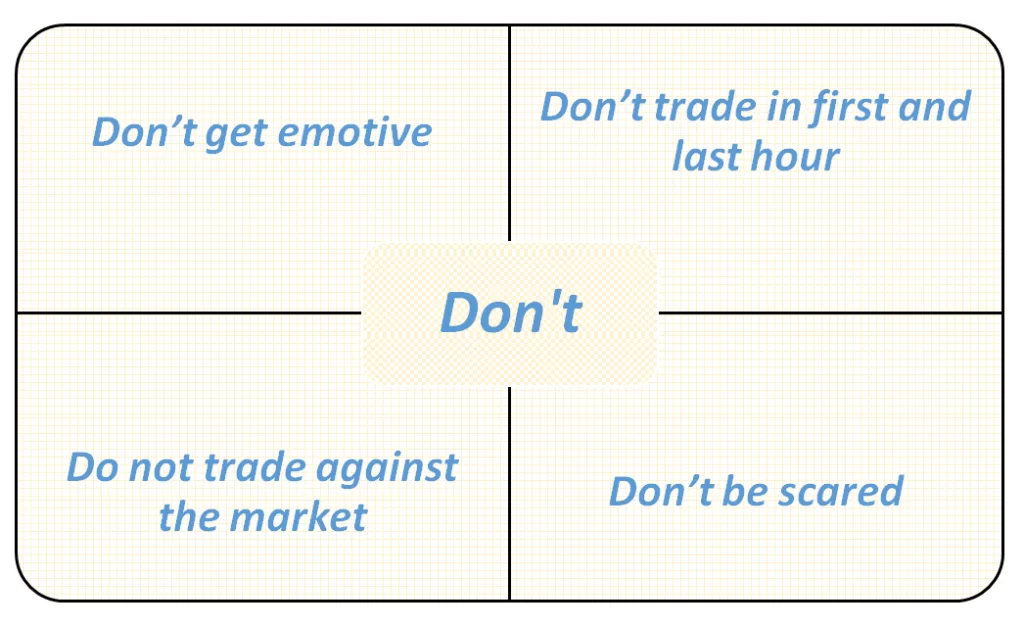

📌 The basic Don’ts in intraday trading for protecting losses are discussed below:

#1 Don’t get emotive

In Intraday trading it is often seen that emotions play a huge role as traders tend to invest more or buy more when a particular stock when the price rises Hence, it can lead to heavy losses. The traders have to take decisions practically without being emotionally attached to the stock. It is really important to focus on facts and make informed decisions to earn 5000 Per Day in Intraday profit.

#2 Don’t trade in first and last hour

The best exercise in intraday trading to earn Rs 5,000 a in a day is by avoiding early hours and last hours of trading in a day because the major changes in the market happen in this time which can lead to high losses for the trader.

#3 Do not trade against the market

The trader should think twice before moving against the market as in the hope that the market will change at the end of the day can be over-ambitious. The trader should be diligent and careful while going against the market.

#4 Don’t be scared

In intraday trading, it is really important to be confident as a fearful mind ought to make mistakes hence the investor should not be scared of taking risks.

Let’s Sum up

In the end, it is important to understand that the market player’s perception and goals play a huge role to earn in intraday trading and there is no mantra, tip, or rule to determine the market. However, the trader with the help of stock market education and the above techniques can lead to achieving success with experience and time. Last but not least traders should always be cautious while trading in the stock market.

If you are searching for how much one can earn in day trading in India or Earn 5000 Per Day in Intraday Trading then your search ends now!

📌 Conclusion

Intraday trading can be highly rewarding if approached with discipline, strategy, and knowledge. By implementing a stop loss strategy, choosing liquid large-cap stocks, planning proper entry and exit points, and conducting thorough research before investing, traders can significantly reduce risks and improve profit opportunities.

At the same time, it is equally important to avoid common mistakes such as trading emotionally, entering the market during volatile opening or closing hours, and going against the market trend without analysis. Intraday trading is not about luck but about risk management, consistency, and continuous learning.

If your goal is to earn ₹5,000 per day in intraday trading in India, then following the above tips along with strong stock market education will help you build a sustainable trading strategy. Remember, the key to success lies in discipline, patience, and informed decision-making.

📌 FAQ on Intraday Trading in India

Q1. What is the best strategy for intraday trading to earn ₹5000 per day?

The most effective method is the stop loss strategy, which minimizes risks and helps traders avoid emotional decisions. Pair this with selecting large-cap liquid stocks and planning a proper entry and exit strategy.

Q2. Can beginners really earn daily profits in intraday trading?

Yes, beginners can earn profits, but consistent earnings like ₹5000 per day trading require practice, discipline, and proper training. It’s advisable to start with small amounts and gain experience before scaling up.

Q3. Why is stop loss important in intraday trading?

Stop loss helps traders limit losses automatically and protect their capital. It also ensures decision-making remains objective and emotion-free, which is crucial in fast-paced markets.

Q4. Which stocks are best for intraday trading in India?

Generally, large-cap and high-volume stocks are preferred as they offer better liquidity, faster execution, and reduced risk compared to penny or low-volume stocks.

Q5. What should traders avoid in intraday trading?

- Trading during the first and last hour of the market.

- Making emotional decisions when prices rise or fall suddenly.

- Going against the market trend without proper research.

- Being fearful or overconfident, both of which can cause mistakes.

Q6. Is intraday trading safe for long-term wealth creation?

Intraday trading is ideal for short-term profits, not for long-term wealth building. For long-term growth, investors should consider delivery-based trading, mutual funds, or SIPs.